If gold imports by India are going to be 1000 tons in 2015, at current rates it is worth $34.64 b or Rs.2,530 b, never mind the gaps in the exchange rate. I have argued in the past that it is not the brightest idea of investment. One has got to be inclined towards stupidity to spend that kind of cash in a commodity that the majority still considers to be the last resort.

It is clear from history that whenever there has been a crisis and the consequent loss of faith in a currency, gold has been perceived to be the savior. May be because it glitters, or may be because it is finite, whatever the reason, people have held on to gold for protection. It could well have been some other item, not gold, but gold it is.

I don't care what portion of those imports are meant for government reserves and what for public consumption. The fact is that much of gold has to be imported by India which puts a serious dent on its current account. At least we haven't got much choice when it comes to imports of oil, which is another item that affects the country's public finance. But, haven't we got discretion when we spend on gold? There is also depreciation of the rupee year-on-year, which affects the cost of imports. If only people had been a little more rational, both the country and themselves would be better off.

Gold does not do much other than being stationary in as much time as we want to consider. Gold prices move such that only greater fool theory would fetch satisfactory returns for the investor. Apart from small doses for decorative consumption purposes for those who fancy, and some for industrial purposes, gold doesn't serve much purpose. However, the opportunity cost of gold imports is significant. The cash could have been used for purchasing any cash flow generating asset.

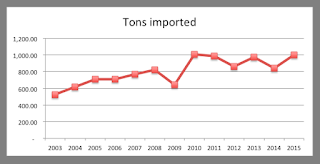

India's gold imports in metric tons from 2003 to 2015 are presented below.

India's gold imports in metric tons from 2003 to 2015 are presented below.

The dollar values of those imports are staggering.

Let's assume that each year the Indians invested the cash, instead of purchasing gold, at an after-tax return of 5%. This is a dumb, low-return investment, even lower than the government treasury and inflation rates.

Yet, they would be smarter than their actual spending, because they would be sitting on a cash pile of $432.02 b as of now. There's more: This cash would earn that dumb 5% year after year.

There is a lot one could do with that cash. One could invest in treasury bonds, or some other instruments, or perhaps invest in a portfolio of stocks picked carefully.

Of course, there's more one could do. Smart people are capable of earning 15+% over the long term. The graph below shows what would be the value of the (cumulative) cash stream today if invested at various rates of return.

The graph not only shows the opportunity cost at various return levels, but also, it mocks people who did not invest in cash flow generating assets. And they did not.

Why they would not do it is a multi-billion dollar question. Don't you think?

Yet, they would be smarter than their actual spending, because they would be sitting on a cash pile of $432.02 b as of now. There's more: This cash would earn that dumb 5% year after year.

There is a lot one could do with that cash. One could invest in treasury bonds, or some other instruments, or perhaps invest in a portfolio of stocks picked carefully.

Of course, there's more one could do. Smart people are capable of earning 15+% over the long term. The graph below shows what would be the value of the (cumulative) cash stream today if invested at various rates of return.

The graph not only shows the opportunity cost at various return levels, but also, it mocks people who did not invest in cash flow generating assets. And they did not.

Why they would not do it is a multi-billion dollar question. Don't you think?

No comments:

Post a Comment