Radhakishan Damani, the promoter of D-Mart supermarkets, lived up to his reputation and market expectations as his company,

Avenue Supermarts Limited listed on the stock exchanges at unprecedented premium valuations.

The bid opened on 8 March, and closed on 10 March; the stock got listed, and started trading on the exchanges on 21 March 2017.

Avenue Supermarts in engaged in the business of organized retail, and operates supermarkets under the brand D-Mart. Prior to the public issue, the company had 561.542 m shares outstanding, of which over 90% was held by the promoters.

The company issued 62.541 m new shares at a price of Rs.299 per share based on which the promoters valued the entire equity in the company at Rs.186 b.

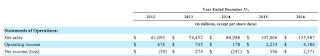

The promoters know the business better than others is a fair assumption. Consequently, they must have assessed the business fundamentals, industry, and macro structures before arriving at the issue price. The company earned Rs.3,187 m for the previous year, and Rs.3,874 m for the nine months ended December 2016. When we extrapolate, the net earnings for 2017 would be Rs.5,165 m. Therefore, the issue price is 58 times current earnings and 36 times expected earnings; not quite modest.

The stock closed at Rs.641.60 on 21 March 2017 valuing its total equity at Rs.400 b. The return expectations don't change unless there are changes on intrinsic basis: cash flows, growth, and risk. Yet, the value of the company's equity increased by Rs.213 b in a day.

Of course, it made the promoters, who are already rich, richer. Besides that it showed us a glimpse into the market psyche.

Avenue Supermarts is one of the most profitable

retail chains in India. It is organized into 3 divisions: Foods (50%), Non-foods FMCG (20%), and General Merchandise and Apparels (30%); most of its revenues comes from Maharashtra.

It has three wholly owned subsidiaries, and one associate.

Currently, it operates from 117 stores across the West and South.

Based on its track record and growth plans, the company will require cash to fund its future expansions.

Avenue Supermarts had revenues of Rs.87 b for the nine months (December 2016) and Rs.85 b for 2016; net earnings were Rs.3.87 b and Rs.3.18 b respectively. Net margin increased to 4.47% in 2017 compared to 3.71% (2016).

The annual growth during the past four years was 40% (revenues) and 51% (earnings).

The book value of equity capital in December 2016 was Rs.19.054 b, which will increase to Rs.37.754 b post public issue. Consequently, the return on equity of 21% (2016) will fall down to 14% (projected for 2017). The company cannot double its profits overnight by doubling capital. Also, much of the proceeds is being used to pay down debt; only Rs.7.5 b is being used in operations; while equity capital has doubled, cash used in operations has not.

In order to achieve past growth rate of 40%, the company will have to reinvest 160-250% of its earnings considering its return on equity. It has already been reinvesting in excess of its earnings in the past.

There aren't any free cash flows at the moment; and I don't see any dividends soon either, if the company wants to maintain its growth momentum.

As of December 2016, Avenue Supermarts had cash of Rs.661 m, and debt of Rs.14 b.

Proceeds from the issue will be used for repaying a significant part of debt.

The company had financial expenses of Rs.907 m for the nine months (December 2016), which might seem likely to decrease in the coming years. However, as we noted, the company needs reinvestment far in excess of profits in order to sustain its growth rate. Where would it come from? I see two options: reduce growth rate expectations, or borrow again. By retiring its high cost old debt, the company may have plans to borrow again at current lower rates. Anyway, I would not count on significant increase in profits due to reduction in interest costs. In fact, its free cash flows might remain negative for much long and much worse compared to the past due to higher reinvestment.

The company might earn Rs.5.16 b (extrapolated) for equity in 2017. At its closing value on 21 March of Rs.400 b, the markets are pricing Avenue Supermarts at 77 times its projected earnings. I will keep the intrinsic valuation for another day. The question now is: is the market correct in its pricing mechanism? Where does Avenue Supermarts stand in the expectations game?

So what has happened post public issue? First what has not happened: Avenue Supermarts' revenues and profits have not increased; its cash flows, growth, and risk parameters have not changed significantly. There could be some changes in costs due to accessibility of public markets and in expectations due to public market investors. The company's corporate governance will be monitored more closely.

Avenue Supermarts is now worth top 6 retailers together. The next best in terms of market-cap are Pantaloons at Rs.117 b and Future Retail at Rs.116 b.

Some individuals and entities have gotten richer. The lead managers got richer by Rs.94 m. Certain management personnel are collectively worth Rs.1 b now.

The promoters, owning 82% of equity, are worth Rs.329 b now.

Since their cost of acquisition was negligible, the return on investment is exceptional.

Do they deserve this? Of course, they do. This is how free markets reward capitalists.