The spirit business in India is going to be international soon.

Diageo is going to acquire a majority stake in United Spirits. The price: Rs.11,000 crores for 53.4% ownership. That gives a valuation for the entire company at about Rs.20,600 crores. As part of the deal Diageo has initiated an open offer to acquire 26% stake in the company at a price of Rs.1,440 per share.

The consolidated numbers as per 2012 annual report are noted below:

We don't have access to the latest balance sheet. Regulators should do something about it.

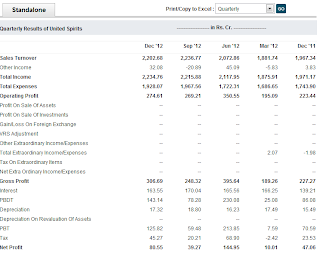

Stand-alone basis (quarterly) income statements:

Price movement for the last 6 months shows the real spirit:

At the current share price of Rs.1,895 per share, the market value of the company is about Rs.24,785 crores.

Given large debt and low income, is the price paid by Diageo justified? Acquisitions are usually rationalized by quoting synergy and control as value enhancements. Sure there is synergy in this deal. Indian market for Diageo and International market for United Spirits. And sure Diageo will be able to bring in its own international expertise due to its control. But how much of this will fructify only time will tell.

The present reality is that debt is too high, profits are not that great and there is Rs.5,000 crores goodwill sitting in the books.

Question: Who is going to subscribe to the open offer at Rs.1,440?

Those who want to lose money.

Question: Is Rs.24,785 crores for this business too high or too low?

Remember what I said before....Synergy and control.

Who is kidding here? Time will tell.

Diageo is going to acquire a majority stake in United Spirits. The price: Rs.11,000 crores for 53.4% ownership. That gives a valuation for the entire company at about Rs.20,600 crores. As part of the deal Diageo has initiated an open offer to acquire 26% stake in the company at a price of Rs.1,440 per share.

The consolidated numbers as per 2012 annual report are noted below:

We don't have access to the latest balance sheet. Regulators should do something about it.

Stand-alone basis (quarterly) income statements:

Price movement for the last 6 months shows the real spirit:

At the current share price of Rs.1,895 per share, the market value of the company is about Rs.24,785 crores.

Given large debt and low income, is the price paid by Diageo justified? Acquisitions are usually rationalized by quoting synergy and control as value enhancements. Sure there is synergy in this deal. Indian market for Diageo and International market for United Spirits. And sure Diageo will be able to bring in its own international expertise due to its control. But how much of this will fructify only time will tell.

The present reality is that debt is too high, profits are not that great and there is Rs.5,000 crores goodwill sitting in the books.

Question: Who is going to subscribe to the open offer at Rs.1,440?

Those who want to lose money.

Question: Is Rs.24,785 crores for this business too high or too low?

Remember what I said before....Synergy and control.

Who is kidding here? Time will tell.

No comments:

Post a Comment