Tesla Motors is a great company to read about and talk about. It was formed in 2003 to prove that electric cars are better, and more affordable, than gasoline-driven cars of today. That's a cool statement. There are more than 50,000 Tesla cars on the road now. Tesla owners enjoy the benefit of charging at home so they never have to visit a gas station. By 2020, Tesla's $5 b gigafactory, being built in Nevada, will produce more lithium ion cells than all of the world's combined output in 2013. Tesla is not just an automaker, but also a technology and design company with a focus on energy innovation. Super cool.

Tesla's models include:

Tesla Roadster

Tesla Model X

Tesla Model 3 is supposed to be the best-selling car in the coming years. For under $40,000 it is going to be more affordable, and meant for the public at large.

Then there are Tesla Supercharger Stations which are free connectors that charge Tesla cars in minutes instead of hours, based on find-charge-drive-on model.

Super-duper cool. What next?

Naturally, there has been a lot of hype around managers of the company, and they have a lot to deliver.

So far the shareholders have gained much from Tesla. From the IPO price of $17 per share, it is now $203 per share, making its total equity worth $25 b.

Not so bad.

And Elon Musk is an extraordinary individual. He owns 27% of Tesla, and has lofty targets for it. Yet, when he said what he said recently it was a jaw-dropping moment. He said, by 2025 Tesla would be like what Apple is today. He didn't seem like in jest, though he seemed more like in zest.

Apple is worth $750 b now. But, Musk said Tesla would be worth only $700 b by 2025, not $750 b. He has $50 b savings in that, rather bold, statement. While we don't have foresight in terms of what's going to take place in future, and that includes financial predictions, many of us would rather keep our predictions private, lest we make fools of ourselves. That fear of mocking ourselves keeps us quiet. Nevertheless, there are people who don't care about all these silly things. They march on. We can applaud them, and why not? or we can mock them. I would rather do neither. All I want to do is some math and check where that statement takes us.

Let's look at Apple first.

Now Tesla.

I have only included annual numbers. Apple has completed one quarter after that is not a big deal in the bigger picture.

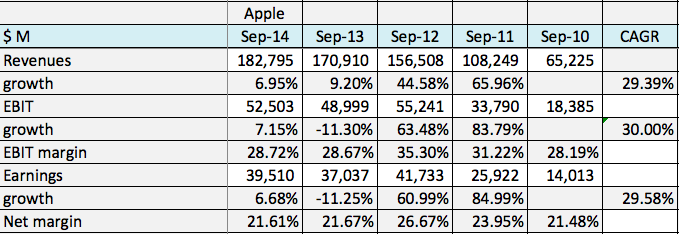

From $65 b revenues in 2010 Apple grew at 29.39% annually over four years. Tesla has a lower base for revenues; so growth potential is more imminent. Let's hold on to this thought for the moment. Apple's margins have been very impressive, and both operating and net earnings have also grown accordingly. Apple's operating profits are $52.5 b now. Tesla, whereas, has yet to show profits. But, it has technology; so it is only a matter of time. Let's again keep this thought.

Tesla has invested about $1.5 b in operating capital (may be a little more if we include research and development costs expensed), and billions more are yet to be invested. In other words, its existing assets are minuscule compared to its growth assets. What is yet to come is going to be disruptive. Hold on to it again.

To get to Apple, we have two routes for Tesla.

First is to get Apple's current numbers and reach there in 2025.

To get to Apple, we have two routes for Tesla.

First is to get Apple's current numbers and reach there in 2025.

EBIT multiple is not the best one to use when we are dealing with equity market cap. To use EBIT we have to assume similar capital structure for Tesla. Still, we need big operating earnings for Tesla in 2025.

Tesla should look like this in 2025.

Revenues should increase by almost 50% annually for the next ten years, and margins should be very high. But then again, the markets will have to give an earnings multiple of nearly 18. Can Tesla pull this off? Of course anything is possible; don't we know it has a very disruptive technology?

Second is to use the automakers (industry) numbers.

In fact, we should be using normalized data for the industry as the business is a bit cyclical. It is also just a coincidence that $700 b is close to the combined market cap of all the above automakers. Nevertheless, doesn't it look formidable?

If we pick the best performance from the automakers data above (i.e. Volkswagen's revenue and Hyundai's net margin, and then Toyota's revenue and earnings multiples), we get Tesla in 2025 as below.

Yet, $700 b appears too far off. But then, remember again that Tesla is not an automotive company; it is a technology company with super powers. We have to do something different, and disruptive too. That leads us back to Musk.

Tesla should look like this in 2025.

Revenues should increase by almost 50% annually for the next ten years, and margins should be very high. But then again, the markets will have to give an earnings multiple of nearly 18. Can Tesla pull this off? Of course anything is possible; don't we know it has a very disruptive technology?

Second is to use the automakers (industry) numbers.

In fact, we should be using normalized data for the industry as the business is a bit cyclical. It is also just a coincidence that $700 b is close to the combined market cap of all the above automakers. Nevertheless, doesn't it look formidable?

If we pick the best performance from the automakers data above (i.e. Volkswagen's revenue and Hyundai's net margin, and then Toyota's revenue and earnings multiples), we get Tesla in 2025 as below.

Yet, $700 b appears too far off. But then, remember again that Tesla is not an automotive company; it is a technology company with super powers. We have to do something different, and disruptive too. That leads us back to Musk.

So, revenues will have to grow annually at close to 60% for the next ten years and reach to $346 b, net margin should be 10%, and the markets should give earnings multiple of 10, and presto! Tesla has a market cap of $692 b. This also translates into a revenue multiple of 2.

But, it is still $8 b short; never mind, this is only a back of the envelope exercise; actual numbers would be very different. For how different they can get, we have only to wait and watch.

But, it is still $8 b short; never mind, this is only a back of the envelope exercise; actual numbers would be very different. For how different they can get, we have only to wait and watch.

How many cars and batteries, and what else, and at what price Tesla needs to sell by 2025 to get $346 b in revenues? Keep those thoughts for the moment.

There is also this argument: how many of us predicted ten years back that Apple would be worth $750 b by 2015?