Castrol is in the business of manufacturing and marketing of lubricants, and is mainly operating in the automotive and industrial sectors in India. Automotive segment contributes over 85% of revenues and earnings. Its manufacturing plants are located in Patalganga, Paharpur and Silvassa. Currently, Castrol's exports are negligible. Lubricants are made by blending base oil with additives. Its main raw material is base oil, which is largely imported, thus the company is exposed to foreign exchange risk.

Castrol sells several products under its brand:

Engine oil for cars: Castrol Edge, Castrol Magnatec, Castrol GTX

Specifically for Tata and Maruti cars: Castrol GTD, Castrol Maruti Genuine oils

Automatic transmission fluid for cars, trucks and buses: Castrol ATF Dex II

Engine oil for motorcycles and scooters: Castrol Power1, Castrol Activ, Castrol Go

Engine for trucks and buses: Castrol Vecton, Castrol CRB, Castrol Tection, Castrol RX

Antifreeze and coolants for trucks and buses: Castrol coolant

Manual transmission fluids for trucks and buses: Castrol Manual

Castrol also makes engine oil, driveline fluid, and greases for off-road vehicles.

As per the company's presentation, it is the largest lubricant player in India with the largest network of 380 distributors servicing over 105,000 retail dealers. Again as per the company's presentation, Castrol Activ, Castrol GTX, and Castrol CRB Plus are the largest selling engine oils in India.

Castrol India is owned by Castrol Limited (71%), which also has board representation. LIC owns 4.2%, and Aberdeen Global Indian Equity (Mauritius) Ltd owns 1.40% of shares in the company.

Its board comprises:

Three non-executive directors are nominated by the parent company, Castrol Limited, UK.

Management of Castrol comprises:

Remuneration to the management was Rs.41.40 m in 2014, approximately, 0.12% of revenues.

There were 494.56 m shares outstanding as of 31 March 2015.

The company pays approximately 2-2.50% of revenues as royalty to the parent company. In 2014, royalty amounted to Rs.730 m. In the last seven years, it has paid out Rs.4.76 b in royalties.

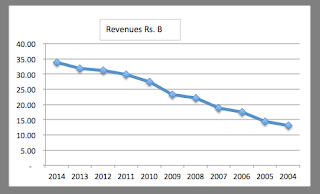

In the last five years, revenues grew 7.91% annually, and in the last ten years, 9.98%.

Castrol had revenues of Rs.33.92 b in 2014, up by 6.69% over 2013. Previous two years growth has not been noteworthy (1.88% in 2013 and 4.66% in 2012) either.

Year-on-year, sales volumes have been falling. Clearly, the company is struggling to increase its revenues, although, there seems to be some pricing power. Castrol's products command about 20% premium over the competition on average. Price per litre has increased by 8.89% and 11.46% annually in the last five and ten years respectively outpacing revenue growth.

The aggressive pricing strategy by local as well as international competition, in an attempt to gain market share, and commoditization of products in the premium segments, has had an impact on the operating margins. Castrol has, however, demonstrated sustainable operating margins.

Return on capital is absurd with such little capital employed. Return on equity has been quite good, and should be much better in the coming years due to the capital reduction program.

There isn't much change in its earnings per share over the past five years, and this is without any dilution in shareholding.

Castrol is operating with a capital of only Rs.653.30 m compared to Rs.2,348.80 m in 2004, and the business has demonstrated that its current operations do not require much capital. Naturally, it has been generous in terms of dividends payout.

It looks like Castrol is facing severe competition in the market, is not able to increase its market share, sales volume, and revenues in any meaningful manner. Over the last seven years, it has not made any reinvestment in the business. Its savings from working capital and depreciation have more than compensated its whatever little capex program.

During 2014, Castrol returned half of its share capital, i.e. Rs.5 per share back to its shareholders under the capital reduction scheme amounting to Rs.2.47 b. Castrol had Rs.4.31 b of cash as of 31 December 2014.

Castrol does not need much capital is evident from its liberal dividends payout.

Castrol India is owned by Castrol Limited (71%), which also has board representation. LIC owns 4.2%, and Aberdeen Global Indian Equity (Mauritius) Ltd owns 1.40% of shares in the company.

Its board comprises:

Three non-executive directors are nominated by the parent company, Castrol Limited, UK.

Management of Castrol comprises:

Remuneration to the management was Rs.41.40 m in 2014, approximately, 0.12% of revenues.

There were 494.56 m shares outstanding as of 31 March 2015.

The company pays approximately 2-2.50% of revenues as royalty to the parent company. In 2014, royalty amounted to Rs.730 m. In the last seven years, it has paid out Rs.4.76 b in royalties.

Castrol does not have any subsidiaries, and operates in India as a stand-alone entity.

In the last five years, revenues grew 7.91% annually, and in the last ten years, 9.98%.

Castrol had revenues of Rs.33.92 b in 2014, up by 6.69% over 2013. Previous two years growth has not been noteworthy (1.88% in 2013 and 4.66% in 2012) either.

Year-on-year, sales volumes have been falling. Clearly, the company is struggling to increase its revenues, although, there seems to be some pricing power. Castrol's products command about 20% premium over the competition on average. Price per litre has increased by 8.89% and 11.46% annually in the last five and ten years respectively outpacing revenue growth.

The aggressive pricing strategy by local as well as international competition, in an attempt to gain market share, and commoditization of products in the premium segments, has had an impact on the operating margins. Castrol has, however, demonstrated sustainable operating margins.

Return on capital is absurd with such little capital employed. Return on equity has been quite good, and should be much better in the coming years due to the capital reduction program.

There isn't much change in its earnings per share over the past five years, and this is without any dilution in shareholding.

Castrol is operating with a capital of only Rs.653.30 m compared to Rs.2,348.80 m in 2004, and the business has demonstrated that its current operations do not require much capital. Naturally, it has been generous in terms of dividends payout.

It looks like Castrol is facing severe competition in the market, is not able to increase its market share, sales volume, and revenues in any meaningful manner. Over the last seven years, it has not made any reinvestment in the business. Its savings from working capital and depreciation have more than compensated its whatever little capex program.

During 2014, Castrol returned half of its share capital, i.e. Rs.5 per share back to its shareholders under the capital reduction scheme amounting to Rs.2.47 b. Castrol had Rs.4.31 b of cash as of 31 December 2014.

Castrol does not need much capital is evident from its liberal dividends payout.

Castrol has been generating free cash flows to firm all through, which it has been returning back to its shareholders.

From 2004 to 2014, it generated free cash flows to firm of Rs.33.19 b, and paid out Rs.27.88 b as dividends.

Castrol and national oil companies have a market share of 55% (in terms of volumes), 20% is with other multinational companies, and 25% is with several local small competitors. These small players have been competing aggressively with lower prices and higher sales promotions to gain market share.

The management acknowledges that the industry has also witnessed a trend of some OEMs introducing lubricants under their own brand name, further impacting the competitive landscape.

As per the management: Lubricant volume consumption for the same rate of use decreases, while per unit cost and price realization increases. Therefore, other drivers remaining unchanged, the growth in demand for lubricants is expected to lag vehicle population growth rate in the foreseeable future.

Castrol spends significant amount on advertising; it has spent Rs.8.82 b in the last seven years. It is doing what is required in order to keep its brands strong.

Having heard the management, it is clear that Castrol is going to face challenges in increasing volume growth, and is dependent upon price increases to scale up revenues. It does not have any plan for increasing production capacities, and consequently, most of the free cash generated is promptly returned back to the shareholders. This is the correct thing to do for a manager if there aren't any investment opportunities, and there is no debt to repay.

Castrol has provided significant value to its long term shareholders. Its current market value of equity is Rs.211.94 b; its high was Rs.30.28 b in 2004. Annual return for the shareholders has been massive.

As it is the case, there are many stories for us to read, here are a few:

Castrol optimistic about lubricant market and growth;

India is a very big market for Shell;

Gulf Oil Lubricants India on a smooth drive;

Castrol's volumes are likely to grow 2-3% annually in the next few years;

In the coming years, Castrol should grow at a very modest rate, yet generate a fair amount of free cash flows, unless it does or witnesses something dramatic.

Based on a perpetual growth model, i.e. assuming that Castrol will be able to grow its current free cash flows perpetually, the current market price would be justified depending upon the market's choice of a combination of the expected return and perpetual growth rate.

In other words, the market is assuming that if the expected return is 10%, the perpetual growth rate of free cash flows would have to be 7.74% to justify the market price of Rs.432.10. If the expected return increases to 18%, free cash flows would have to grow at 15.74% perpetually.

If you want to buy the stock today, you have to be comfortable with the perpetual rate for the free cash flows to grow. Gotcha!

Based on a perpetual growth model, i.e. assuming that Castrol will be able to grow its current free cash flows perpetually, the current market price would be justified depending upon the market's choice of a combination of the expected return and perpetual growth rate.

In other words, the market is assuming that if the expected return is 10%, the perpetual growth rate of free cash flows would have to be 7.74% to justify the market price of Rs.432.10. If the expected return increases to 18%, free cash flows would have to grow at 15.74% perpetually.

If you want to buy the stock today, you have to be comfortable with the perpetual rate for the free cash flows to grow. Gotcha!

No comments:

Post a Comment