New York Times was founded in 1851, and the company got listed as a publicly traded stock from 1969. The equity of the business is worth about $4 b today. In 2007, it was worth $3.8 b (high) and $2.3 b (low). In 2012 it hit some low times when the high market value was $1.6 b and low was $889 m. For the year 2011, it posted operating profits of $162 m and net loss of $40 m. There were several items of exceptional nature in that year probably. The broader point though is that there hasn't been much for its stockholders during the last decade.

Print media has been going through some tough, very tough times, and the digital media does not seem to be too promising as a viable business either. NY Times has been trying to transform itself onto digital platform, but the results are not interesting. The competitive advantages are lacking in media business in general.

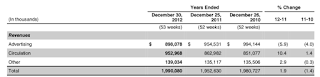

In 2008, its advertisement revenues fell about 13%.

And by 2012, they were less than a million dollars.

For 2017, its latest reported financial year, the advertisement revenues were $558 m, but increase in subscription revenues have ensured total revenues stayed on course.

It had operating profits of $188 m, debt of $250 m, and the present value of its non-cancelable leases was $47 m. It also had cash and non-operating assets of $735 m. The operating margins have improved over the years to about 10%.

But the return on equity has not been encouraging: It was 21% in 2007; 17% in 2010; 26% in 2012; 10% in 2013. Other than for these years, the return on equity has been pretty dismal. If this has to continue, the business is not going to be a profitable venture for its shareholders.

But then, who are its shareholders? The business is controlled by the Sulzberger family through a Trust. The company has two classes of shares: class A and class B.

While both classes share equally in profits, the voting power is controlled by the class B owners, and the family trust owns more than 90% of class B shares. That means any takeover threat is virtually eliminated. Over 50% of class A shares are owned by 6 investors: Vanguard, BlackRock and Darsana Capital own (8% each), Fairpointe Capital and Wellington Management (5% each), and Carlos Slim Helu owns over 16% of class A shares.

As far as the family trust is concerned, there is a case for retaining control for emotional and prestige reasons. But those 6 outside investors have some $2 b stuck in the business earning quite low on its equity. They may have their reasons, but it does not look fit for capitalists.

After a long time, total revenues grew year on year. 2017 saw over 7% increase in revenues, and the stock has hit $25. However, purely on pe terms, the price looks exorbitant. After denying dividends for 4 years from 2009 to 2012, they have been restored and increasing from the year 2013. The latest dividend per share is $0.16.

Free cash flows from business have not been great. NY Times generated some cash in 2012 and 2013 through sale of About group for $300 m and New England Media group for $70 m, and debt was brought down to $250 m.

At present, the equity is $900 m and non-operating capital is $735 m. Let us suppose that $250 m debt is fully paid off through sale of non-operating assets; there will be savings on finance costs. The business then will have $415 m operating assets and $485 m non-operating assets financed by $900 m equity. Now for the shareholders to make their investment business sense, the return on equity should be more than risk-free rate of return which is about 3%. Let's say the investors expect 8% return on their capital. The total return on equity should then be $72 m of which about $15 m (3%) will be provided by non-operating assets. The balance $57 m will have to be supplied by operating assets.; that is a return on operating capital of 14%.

It will not be easy to sustain 14% rate of return on capital for long though. A much better choice probably would be this: Excess capital which is deployed in non-operating assets may be used to pay additional dividends or buyback shares. Let's assume it will be used for dividends; so $485 m will be a windfall for the shareholders. Now the business will have only operating assets of $415 m financed entirely by equity. The expected rate of return is 8%. The business will have to generate only $33 m in profits; $24 m less profits will be relatively easier to make. Payout all profits after mandatory capital spends as dividends. Business will be mature, and valuing it will be simpler. Keep the story going as long as it is economically viable.

The outside investors will have to have faith that New York Times will be able to deliver their expected rate of return. The family trust is going to be probably fine since its objectives are different from class A share owners.

After a long time, total revenues grew year on year. 2017 saw over 7% increase in revenues, and the stock has hit $25. However, purely on pe terms, the price looks exorbitant. After denying dividends for 4 years from 2009 to 2012, they have been restored and increasing from the year 2013. The latest dividend per share is $0.16.

Free cash flows from business have not been great. NY Times generated some cash in 2012 and 2013 through sale of About group for $300 m and New England Media group for $70 m, and debt was brought down to $250 m.

At present, the equity is $900 m and non-operating capital is $735 m. Let us suppose that $250 m debt is fully paid off through sale of non-operating assets; there will be savings on finance costs. The business then will have $415 m operating assets and $485 m non-operating assets financed by $900 m equity. Now for the shareholders to make their investment business sense, the return on equity should be more than risk-free rate of return which is about 3%. Let's say the investors expect 8% return on their capital. The total return on equity should then be $72 m of which about $15 m (3%) will be provided by non-operating assets. The balance $57 m will have to be supplied by operating assets.; that is a return on operating capital of 14%.

It will not be easy to sustain 14% rate of return on capital for long though. A much better choice probably would be this: Excess capital which is deployed in non-operating assets may be used to pay additional dividends or buyback shares. Let's assume it will be used for dividends; so $485 m will be a windfall for the shareholders. Now the business will have only operating assets of $415 m financed entirely by equity. The expected rate of return is 8%. The business will have to generate only $33 m in profits; $24 m less profits will be relatively easier to make. Payout all profits after mandatory capital spends as dividends. Business will be mature, and valuing it will be simpler. Keep the story going as long as it is economically viable.

The outside investors will have to have faith that New York Times will be able to deliver their expected rate of return. The family trust is going to be probably fine since its objectives are different from class A share owners.

No comments:

Post a Comment